Getting The Bank Of Makati To Work

Wiki Article

A Biased View of Bank America

Table of Contents4 Easy Facts About Bankrupt DescribedBankruptcy Can Be Fun For EveryoneLittle Known Questions About Bank At First.The Basic Principles Of Bank Account How Bankruptcy can Save You Time, Stress, and Money.

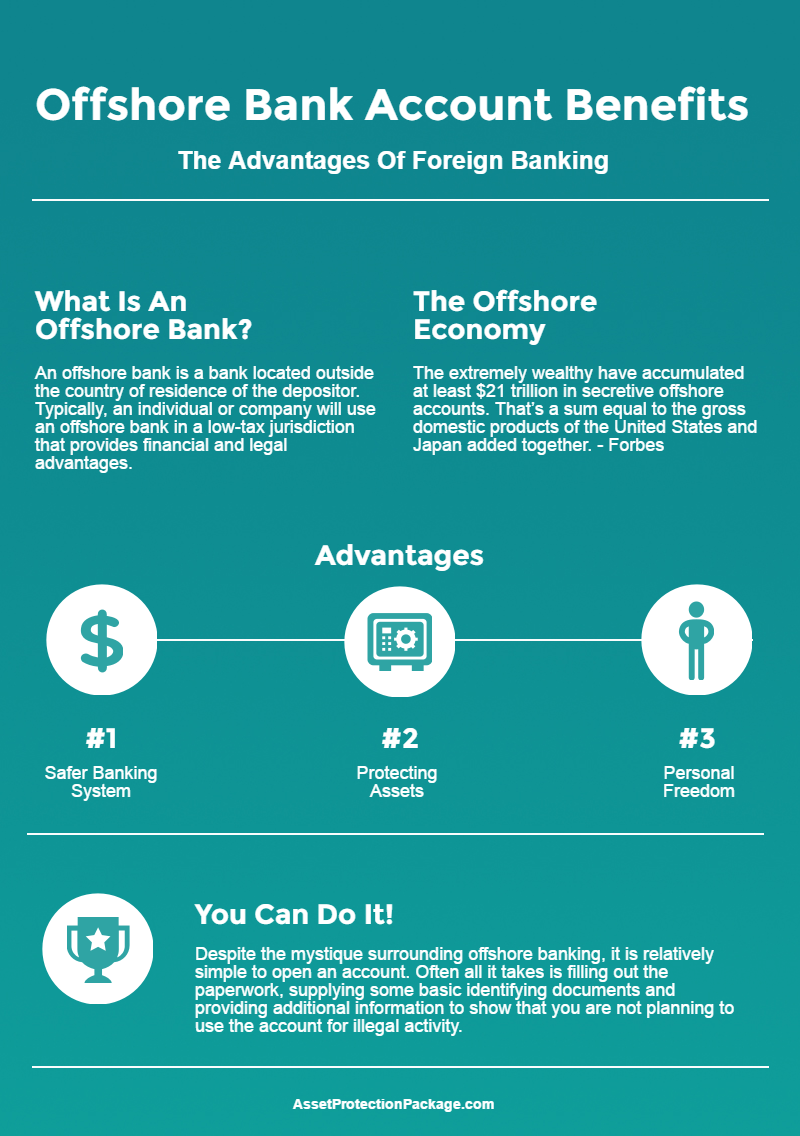

What Is an Offshore Banking Device (OBU)? An offshore financial unit (OBU) is a financial institution shell branch, located in another worldwide economic. A London-based bank with a branch located in Delhi. Offshore banking units make loans in the Eurocurrency market when they accept down payments from foreign banks and also various other OBUs.

OBUs are concentrated in the Bahamas, the Cayman Islands, Hong Kong, Panama, as well as Singapore. Sometimes, overseas banking devices may be branches of homeowner and/or nonresident financial institutions; while in various other instances an OBU might be an independent establishment. In the first case, the OBU is within the straight control of a moms and dad company; in the 2nd, despite the fact that an OBU may take the name of the moms and dad firm, the entity's monitoring and also accounts are different.

The Single Strategy To Use For Bank America Login

Similar to other OBUs, IBF deposits are restricted to non-U - bank at first.S candidates.Bank situated outside the nation of residence of the depositor An offshore financial institution is a bank managed under worldwide banking license (usually called offshore license), which typically bans the bank from establishing any kind of organization tasks in the jurisdiction of establishment. As a result of much less policy as well as openness, accounts with offshore financial institutions were often made use of to conceal undeclared earnings. OFCs typically likewise levy little or no corporation tax obligation and/or individual earnings and also high straight tax obligations such as task, making the expense of living high. With worldwide enhancing steps on CFT (combatting the financing of terrorism) and AML (anti-money laundering) conformity, the overseas financial field in most jurisdictions was subject to altering policies.

Some Known Details About Bank Account

OFCs are claimed to have 1. 2% of the world's populace as well as hold 26% of the globe's wealth, consisting of 31% of the internet profits of USA multinationals. A team of activists state that 13-20 trillion is held in offshore accounts yet the actual figure can be much greater when thinking about Chinese, Russian as well as US deployment of capital globally.Much like a criminal making use of a wallet determined and taken as proceeds of criminal activity, it would certainly be counterintuitive for any individual to hold assets extra. Moreover, much of the capital flowing via automobiles in the OFCs is aggregated investment funding from pension plan funds, institutional as well as personal capitalists which has to be deployed in industry around the Globe.

Banking advantages [modify] Offshore banks offer access to politically and economically stable jurisdictions. This will certainly be a benefit for residents of locations where there is a risk of political turmoil, that fear their possessions might be frozen, seized or vanish (see the as an example, during the 2001 Argentine recession). Nevertheless, it is likewise the situation that onshore financial institutions offer the very same benefits in regards to security - bank at first.

Top Guidelines Of Bank At First

Advocates of overseas financial typically define federal government regulation as a kind of tax obligation on domestic financial institutions, lowering passion browse around here prices on deposits. Nevertheless, this is scarcely real currently; most offshore countries supply very comparable passion rates to those that are offered onshore as well as the overseas financial institutions currently have significant compliance needs making specific categories of clients (those from the USA or from greater risk account nations) unappealing for various reasons.Those who had actually transferred with the very same banks onshore [] received all of their money back. [] In 2009, The Isle of Guy authorities were keen additional hints to direct out that 90% of the plaintiffs were paid, although this just referred to the number of people who had received money from their depositor payment plan and also not the quantity of cash reimbursed.

Only offshore centres such as the Isle of Man have declined to compensate depositors 100% of their funds complying with financial institution collapses. Onshore depositors have been reimbursed in complete, regardless of what the settlement restriction of that country has stated. Thus, banking offshore is historically riskier than financial onshore (Bank). Offshore banking has actually been connected in the past with the underground economic climate and organized criminal offense, thanks to movies such as the Company through money laundering.

Not known Details About Bank

Overseas financial is a legit financial service made use of by numerous migrants and worldwide workers. Offshore jurisdictions can be remote, and for that reason costly to visit, so physical access can be challenging. [] This problem has actually been reduced to a substantial degree with the arrival and also realization of electronic banking as a sensible system. [] Offshore personal banking is typically much more easily accessible to those with greater incomes, since of the prices of developing and also preserving overseas accounts.

24). A current [] District Lawsuit in the 10th Circuit might have considerably expanded the definition of "passion in" and also "other Authority". [] Offshore savings account are in some cases promoted as the option to every lawful, monetary, as well as property defense strategy, however the benefits are frequently exaggerated as in the more popular territories, the level of Know Your Consumer proof needed underplayed. [] European suppression [modify] In their initiatives to mark down on cross boundary rate of interest payments EU federal governments concurred to the introduction of the Cost savings Tax Obligation Regulation in the form of the European Union keeping tax obligation in July 2005.

Report this wiki page